What Will Happen to the Housing Market When the Foreclosure Moratorium Expires?

Just under 6% of all U.S. mortgages — 2.7 million homes — were in some stage of delinquency at the end of the 2020 year.

Extension of COVID-19 Forbearance and Foreclosure Protections for Homeowners

The actions announced by the White House to extend the moratorium expiration date:

- Extend the foreclosure moratorium for homeowners through June 30, 2021

- Extend the mortgage payment forbearance enrollment window until June 30, 2021 for borrowers who wish to request forbearance;

- Provide up to six months of additional mortgage payment forbearance, in three-month increments, for borrowers who entered forbearance on or before June 30, 2020.

The Federal Housing Finance Agency, the independent agency that oversees Fannie Mae and Freddie Mac, extended forbearance by three months for borrowers coming to the end of their forbearance period. These coordinated actions will cover 70 percent of existing single-family home mortgages.

What will happen after the looming moratorium expiration set for early Summer 2021?

The coming expiration of the foreclosure moratorium in mid-2021 will release the buildup of distressed sales, which will bring down prices. The housing market won’t begin a consistent readjustment until well after the need for government intervention and the pandemic response have ended, a timeline which continues to shift.

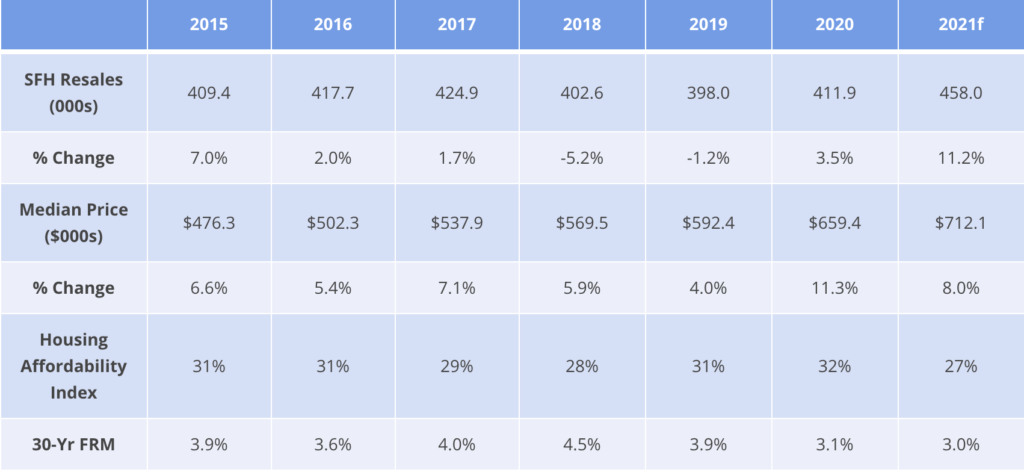

For the majority of the pandemic we have seen housing prices continuously climb, but when government assistance comes to an end and the moratoriums expire, homeowners who have experienced hardship will be faced with the options to resume their payments or sell. This will increase the inventory of homes that are available for sale, therefore lowering demand. For months low interest rates and low inventory has kept the market hot with buyers, and buyers have been bidding home prices upward as they fend for the small selection of homes that are available for sale.

Many homeowners that have considered selling are holding off as they may feel insecure about having strangers view their home as infection rates still exist. There are also the homeowners struggling economically, who are being given a moment of relief from their mortgage payments. Those in default of their mortgage could be choosing to hold onto their home, rather than sell, as they try to rebound their finances as the economy starts to reopen. The big question is, how many homeowners will be able to return to making their mortgage payments? Those that can’t will be forced to sell, or worse, deal with a foreclosure. The amount of homes released onto the market for sale will determine housing prices and only time will tell.

Even though we don’t have a crystal ball, I am certain that we won’t experience a crash like the housing crisis in 2008. These days lenders don’t give low down payment loans, so even if prices drop considerably, homeowners have decent equity, therefore they won’t have a reason to walk away from their mortgage payments. I believe we will experience a correction back to reasonable prices where sellers will walk away with equity, but buyers won’t being in bidding wars.