April 18, 2022

Although the macroeconomic headwinds continue to rise, California’s economy and housing market have yet to slow their upward trajectory. Home sales remain strong, new listings are increasing, and the market remains competitive. Demand is expected to be impacted by higher rates in the second half of the year, but, thus far, California’s residential market is holding up remarkably well..

California Economic Recovery Still on Track in March: The California labor market added another 60,000 new jobs last month as the recovery continues. Unemployment claims also remain below 50,000 suggesting that the recent turbulence in the geopolitical environment or the volatility on Wall Street has not translated into cutbacks in California and that the recovery of the hardest hit sectors by the pandemic are outweighing the increased macroeconomic risks.

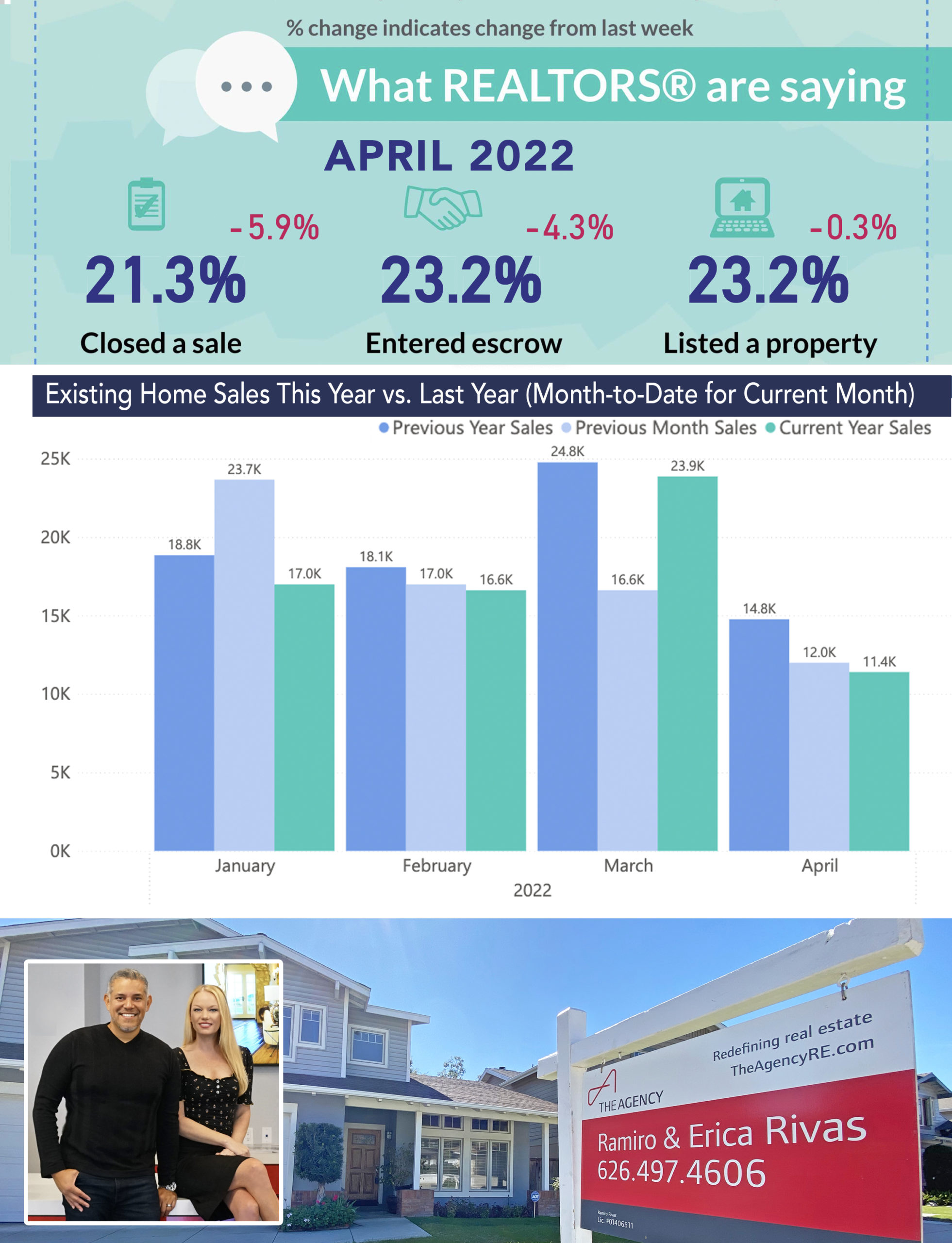

Housing Market Even More Competitive as Higher Rates Kick In: Despite rising interest rates, buyer demand has yet to downshift in California. Home sales likely rose in March from February’s pace and several indicators showed a market that was even more competitive that it was in February with 71% of homes selling above asking prices and the typical home going from list to pending is just 8 days. In addition, the latest survey of REALTORS® suggests that few agents are experiencing buyers putting their search on hold or backing out of existing deals. Many would-be home buyers may be feeling a sense of urgency to complete their purchase before rates rise further, which is keeping the market tight so far.

Peak Inflation May Be In Sight: CPI inflation set another record last month, with overall consumer prices rising by more than 16% on a year-to-year basis—the largest cost of living increase in more than 40 years. However, there are some glimmers of light at the end of the tunnel as most of the increase was driven by rising energy costs associated with global oil supplies and the disruption therein from the conflict between Russia and Ukraine. Stripping out the volatile components of food and energy, so-called “core” CPI rose by a more modest 4% last month. A good sign, though the Fed is unlikely to reverse course on interest rates over the near term.

Active Listings Show Meaningful Growth: The number of homes available for sale continues to trend upward from the lows hit this past winter. Last week, there were more than 26,000 active listings across the state—a significant improvement from the low point of 17,000 at the start of the year. What’s more, the active listings are higher than they were the previous year for several weeks consecutively. Although the total number of homes for sale is still depressed relative to pre-pandemic standards, this is the first-time listings have grown on a year-to-year basis since late 2019. The market remains attractive to home sellers, but rising rates may also be motivating home sellers to make their moves now before rates rise further.

Yield Curve Back in Positive Territory—Both a Plus and a Minus: After dipping into negative territory the previous week, the yield curve, which measures the spread between 2-year and 10-year Treasuries and is typically viewed as an accurate gauge of short run risk in the economy (and likelihood of recession) returned to positive territory last week. On one hand, this is a positive sign that the bond markets are no longer overly-concerned about the sort-run relative to the medium term, indicating a lower risk of recession. However, the yield curve increased last week because 10-year rates rose more than 2-year, which is suggestive of higher mortgage rates in coming months that will harm purchasing power for homebuyers.

Rates Finally Hit 5% Last Week: After lagging behind daily rate quotes, the Freddie Mac average 30-year fixed-rate mortgage rate rose to 5.00% last week from 4.72% the previous week. Although this has been foreshadowed for several weeks, it is significant nonetheless because it marks the highest level of interest rates for purchase mortgages in over a decade. In fact, the last time Freddie Mac reported a 5% weekly interest rate was on February 12, 2011. However, even as rates have risen dramatically, mortgage applications are relatively stable at 2018-2019 levels despite having subsided from the 15-year highs seen last year.

Article by the California Association of Realtors